|

|

|

|

|

|

|

|

|

|

|

|

Markets appear to be stabilizing after an unsettling weekend.

Geopolitical tensions rose over the weekend. Iran attacked Israel from Iranian territory in response to the Israeli attack on an Iranian diplomatic complex earlier this month. The Gaza war continues, as does the Russian/Ukrainian conflict. The world feels fragile.

Increased conflict is putting pressure on oil prices, which is inflationary and will act as an opposing force against higher interest rates. Markets have stabilized over the weekend and have opened in positive territory Monday morning.

The Fear & Greed Index was greedy six weeks ago and now is hovering near fearful territory.

Geopolitical risk will continue to hover over global stock markets.

This is what has caught our eye recently….

The S&P posted the best first quarter since 2019, which was also the last time a year began with three consecutive positive months. The US is proving to be economically strong, inflation is proving to be sticky and the S&P500 is priced for perfection that embeds both interest rate cuts and growth at the same time. On this side of the border, Canadian unemployment is rising, economic growth is slowing and the TSX is lagging its US counterpart. Those looking to see a bounce in the interest rate sensitive names will have to wait a little longer as the Bank of Canada chose to hold interest rates steady last week. With all of this talk about inflation and 2% targets, it is easy to forget that in the past 100 years inflation has averaged 3.1%, which is not too far from our current figures.

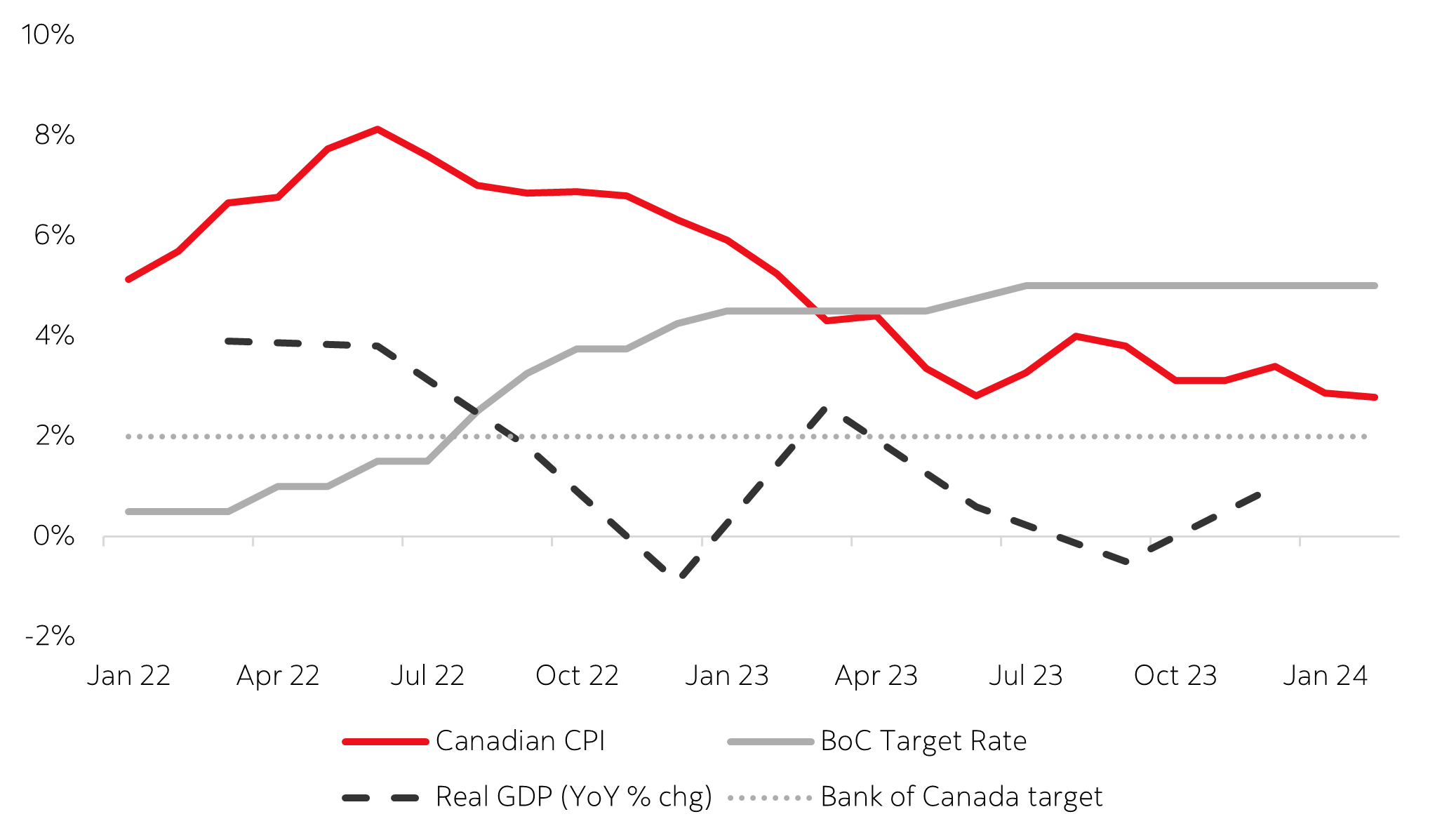

1. The Bank of Canada (BoC) left its policy decision rate unchanged at 5.0% last week for the sixth straight meeting. This was aligned with market expectations. In the press conference, Tiff Macklem indicated that inflation continued to ease gradually, slowing across most major categories. Our inflation rate has come in below 3%, but the government wants to ensure that inflation will not bounce back if they lower rates too soon.

Rising interest rates look to have both cooled inflation and negatively impacted GDP since the BoC began their rate hiking cycle.

CHART OF THE DAY

EUROZONE INFLATION CONTINUED TO TREND IN THE RIGHT DIRECTION, PAVING THE WAY FOR MONETARY POLICY EASING LATER THIS YEAR Sources: Scotia Wealth Management, Bloomberg, Eurostat | As at March 31, 2024

Sources: Scotia Wealth Management, Bloomberg, Eurostat | As at March 31, 2024

11. A recent quote from “Dr. Doom”, Nouriel Roubini

“I’m less worried than in the past… There is a serious possibility of what people refer to as a “no landing” – that growth remains above potential and inflation remains sticky… because of technology and other factors and the Fed doesn’t cut three times, only two, one maybe, some people say zero.”

Warren Buffet writes a letter to his shareholders annually. This latest letter was a little different, as his longtime business partner Charlie Munger passed away in November. Buffett preceded his regular letter with a tribute to Munger fittingly typed in an old-school “certificate of appreciation” style format. I thought you might enjoy this touching eulogy.

Maybe we will end with a Buffett classic quote to guide us.

“Keep things simple and don’t swing for the fences.

When promised quick profits, respond with a quick no”.